Do you know more about the crucial analysis of crop insurance mechanism in India? The Farmers are usually exposed to organic vagaries, which negatively impact their agricultural production and farm incomes.

Among the very best methods to mitigate agricultural dangers arising from natural calamities is adoption of a strong insurance plan.

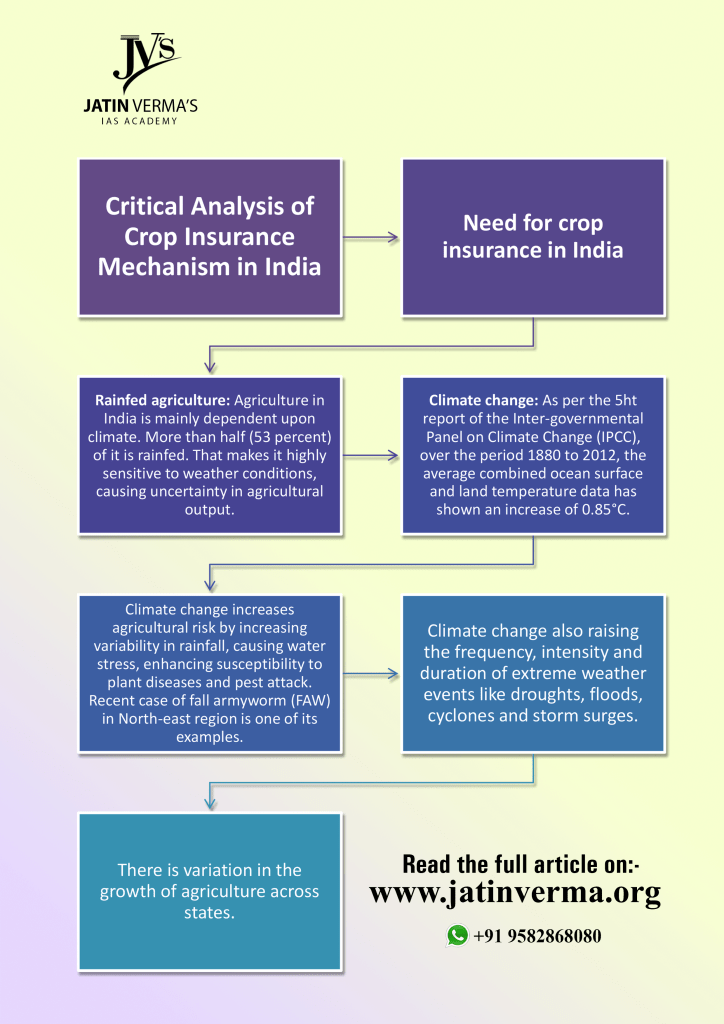

Need for crop insurance in India

- Rain fed agriculture: Agriculture in India is mainly dependent upon climate. More than half (53 percent) of it is rain fed. That makes it highly sensitive to weather conditions, causing uncertainty in agricultural output.

- Climate change: As per the 5ht report of the Inter-governmental Panel on Climate Change (IPCC), over the period 1880 to 2012, the average combined ocean surface and land temperature data has shown an increase of 0.85°C.

- Climate change increases agricultural risk by increasing variability in rainfall, causing water stress, enhancing susceptibility to plant diseases and pest attack. Recent case of fall army worm (FAW) in North-east region is one of its examples.

- Climate change also raising the frequency, intensity and duration of extreme weather events like droughts, floods, cyclones and storm surges.

- There is variation in the growth of agriculture across states.

- Types of risk to farmers: Due to all these factors, Farmers primarily face two types of risks – yield risk and price risk. An unplanned and major variation in either the yield or price of a crop in a particular agricultural cycle can translate into significant losses to the farmer.

- Price risk refers to the uncertainty about prices that farmers receive for their produce. During years of high production, prices of crops slide downwards, affecting the incomes of farmers.

- Yield risk refers to uncertainty regarding the quantity and quality of agricultural product harvested at the end of an agricultural cycle. Yield is mainly affected by the quantum of annual rainfall.